If you are looking for the best rate on your next mortgage or investment property, there are several factors that you need to be aware of before you start shopping for your loan. While interest rates are at historic lows, it doesn’t mean that you will be eligible for the lowest possible rate. What should you be aware of if you don’t want to pay more in interest than you have to?

If you are looking for the best rate on your next mortgage or investment property, there are several factors that you need to be aware of before you start shopping for your loan. While interest rates are at historic lows, it doesn’t mean that you will be eligible for the lowest possible rate. What should you be aware of if you don’t want to pay more in interest than you have to?

Investing in Real Estate? Tips to Get the Best Mortgage Rate

May 6th, 2014The True Story of Life….for Most People. Be Unique!

October 1st, 2013Have you ever just sat and thought about being unique? Being different than everyone else around you? It’s obvious that you’re a unique person, with unique traits, abilities and characteristics, but that’s not what I’m talking about.

The uniqueness I’m referring to is the kind defined by what you do every day, your habits.

The True Story of Life

I stumbled across an image that sums up my point. In this day and time, we live in an age of conformity, and for the bulk of the population in this world, that means joining the workforce.

Working a day job isn’t necessarily a bad thing. Most people are lucky to even have a job, right? Well, that’s because that’s they way they feel, and think.

If they were to feel and think differently, what would happen?

Practical Savings for Normal People

March 20th, 2013 One of the hardest things is wanting to save but not being sure about how to go about it. It feels like all of the books about money and investing are written for people whose jobs pay them six figures. They all say things like “you can totally buy that brand new $100 sweater and save for a Maserati! We’ll show you how!†Where is all the advice for people whose budgets and needs are more about groceries and mortgage payments?

One of the hardest things is wanting to save but not being sure about how to go about it. It feels like all of the books about money and investing are written for people whose jobs pay them six figures. They all say things like “you can totally buy that brand new $100 sweater and save for a Maserati! We’ll show you how!†Where is all the advice for people whose budgets and needs are more about groceries and mortgage payments?

Right Here.

Step One: Open a savings account at your bank and link it to your checking account. You don’t need anything fancy right now; a basic account will do—especially if you can’t afford a hefty initial deposit. When you open the account, check the fees to make sure you don’t get dinged for a low balance. You can usually avoid these by setting up direct deposit or finding a free checking option.

Life Insurance for the Self Employed

November 21st, 2012 In my last blog post I told a murder story, so to stay in alignment with my doomsday streak, I think I’ll write about either you or I dying. That sounds much more interesting anyway! But really, all jokes aside, have you thought about it yet? Have you thought about what will happen to your family if something happens to you? I guess what I’m getting at here is, as an entrepreneur, do you have a life insurance policy?

In my last blog post I told a murder story, so to stay in alignment with my doomsday streak, I think I’ll write about either you or I dying. That sounds much more interesting anyway! But really, all jokes aside, have you thought about it yet? Have you thought about what will happen to your family if something happens to you? I guess what I’m getting at here is, as an entrepreneur, do you have a life insurance policy?

Life Insurance for the Self Employed

I’m sort of a late starter when it comes to life insurance. I’ve only been to the doctors office once in the last decade or so, but recently, I started thinking about all the other factors of life that could happen, leaving my family in an extremely hard spot. Naturally, my solution is to continue building my business, which will continue to pay them monthly, even if I’m not around. But what if something happens to the company I work with, then what will they do? With the economy as sensitive as it has been in the past several years, anything could happen.

3 Personal Finance Strategies for Entrepreneurs and Investors

August 8th, 2012 Mastering personal financial management is essential no matter what level you’re at financially. When you’re an entrepreneur or an investor, you may have the basics figured out, but there are plenty of strategies that you can use to take your finances to the next level. Here are three personal finance strategies that you may want to try out as an entrepreneur or an investor:

Mastering personal financial management is essential no matter what level you’re at financially. When you’re an entrepreneur or an investor, you may have the basics figured out, but there are plenty of strategies that you can use to take your finances to the next level. Here are three personal finance strategies that you may want to try out as an entrepreneur or an investor:

1. Set a Net Worth

When you’re starting out on your financial journey, setting a savings goal may seem like the way to go. As you get further along financially, you should consider switching over to a net worth goal. If you have a specific net worth in mind, this will help you work toward your goal in all areas of your finances. Your net worth can be increased by paying off debt, increasing your income, and the increase in value of your assets.

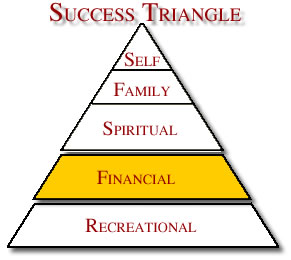

Financial – The Fourth Category of Success

January 14th, 2010 Next up to bat in the 5 Categories of Success is the fourth and most sought after category, Financial! I don’t really know anyone, anywhere, that would say “no” to making a little more money. Some pursue money as if it is the very thing they depend on to sustain life, money being the very air they breathe. Success to many means having lots and lots of money and plenty of time to spend and enjoy having all that money. It’s all about being the P.I.M.P. with the 20 inch rims, the huge mansion and money all over the place. It’s amazing to see someone rise to the top and become wealthier than they have ever been, become the high roller they had always wanted to be, spend all of their money, and end up broke, depressed and out of luck.

Next up to bat in the 5 Categories of Success is the fourth and most sought after category, Financial! I don’t really know anyone, anywhere, that would say “no” to making a little more money. Some pursue money as if it is the very thing they depend on to sustain life, money being the very air they breathe. Success to many means having lots and lots of money and plenty of time to spend and enjoy having all that money. It’s all about being the P.I.M.P. with the 20 inch rims, the huge mansion and money all over the place. It’s amazing to see someone rise to the top and become wealthier than they have ever been, become the high roller they had always wanted to be, spend all of their money, and end up broke, depressed and out of luck.

The Fourth Category of Success – Financial

Having a mansion, cars, boats, ATV’s, planes, maids, employees, nice clothes and all that can dress up your appearance is NOT financial success. Financial success is about having assets. An asset is something of value, or something that can bring your more income…consistent income. The only thing in the list I just mentioned that may be an asset is the mansion. Everything else is a depreciating deficit…..things that cost you more money. Having the cars, boats, atv’s, planes, maids and nice clothes are results of having assets, if you so choose to accumulate those things.

Now, I know many people think that once they achieve financial success that all the other categories will fall into place. They will then have the time and money to improve themselves, their families and their spirituality. To most people, the money fixes everything and makes everything possible. Not the case! If you were a broke, miserable person before falling into financial success, you will eventually become a broke, miserable person again  unless you change you! The financial success comes and STAYS because of who you are being. If you have not become the millionaire in your mind first, then you will not remain a millionaire for long, because your money thermostat is set much, much lower than that. To learn more about how to reset your thermostat, read “Secrets of a Millionaire Mind” by T. Harv Ecker. Great read!

unless you change you! The financial success comes and STAYS because of who you are being. If you have not become the millionaire in your mind first, then you will not remain a millionaire for long, because your money thermostat is set much, much lower than that. To learn more about how to reset your thermostat, read “Secrets of a Millionaire Mind” by T. Harv Ecker. Great read!

Now, financial success to me, is after all of my expenses (ie bills, groceries, mortgage etc) I still have plenty of money to put a portion away for savings, donate a portion for a good cause, invest some back into strengthening my assets  and to live an abundant lifestyle. That’s financial success. It’s not about having just enough to get by. That’s three months away from homeless should tragedy strike. It’s true. How many people have lost homes because they were making just enough to get by and tragedy struck, they lost their job? Too many! I apologize, but I have to recommend another book here. It’s “The Richest Man in Babylon” by George S. Clason. That short, little book will teach you a bit more about what to do with the money you make.

and to live an abundant lifestyle. That’s financial success. It’s not about having just enough to get by. That’s three months away from homeless should tragedy strike. It’s true. How many people have lost homes because they were making just enough to get by and tragedy struck, they lost their job? Too many! I apologize, but I have to recommend another book here. It’s “The Richest Man in Babylon” by George S. Clason. That short, little book will teach you a bit more about what to do with the money you make.

The portal to creating financial success is Entrepreneurship. You must become an entrepreneur. By doing so, you are in control of how much or how little you earn, and the cool thing about entrepreneurship, is you can make a lot of money doing exactly what you love to do. If that is eating donuts all day, you can own a donut shop. If you enjoy teaching kids how to play basketball, you can organize basketball camps and three on three tournaments. If you enjoy it, chances are, you will do well. It’s about finding a way to make it happen. Most likely, things won’t be laid out perfectly for you with ABC instructions on how to create success. To me, that’s the exciting part of it all. You get to take ALL the credit for what you create!

If I can give you a few tips of advice in creating your financial success, it would be this:

- Know what you want. Get very clear. Be creative with your ideas. Be different.

Mastermind with those people who have the results you desire to have.

Mastermind with those people who have the results you desire to have.- Persist without exception until you get what you want. Learn that “The Buck Stops Here!” To learn more about that you can read “The Travelers Gift” by Andy Andrews.

- Burn your boats, meaning, leave no escape routes or back doors. Play with all out MASSIVE action. Play small, get small results. Play big, get big results.

- Be extremely consistent.

Anyone and everyone that has a desire to succeed and the willpower to pursue their dreams has to potential to achieve them. One of the most important concepts that I have learned on the path of financial success, is to simply “Enjoy the Journey!” Life is good and because of you, it will become better and better. Money isn’t everything. Money is a tool, or a gateway to achieving greater things in life. Use it to bless your life, the life of your family and the lives of others in a positive way…….and guys, there’s plenty to go around!